Soon after the Internet moved from the academic to the popular domain, banner advertising followed (1994). Media operators initially sold their inventory directly to media buyers and advertisers but, as the number of web pages exploded, so did the amount of display advertising inventory. It soon made sense to serve display ads via dedicated centralized ad servers operated by the likes of DoubleClick.

DoubleClick

DoubleClick’s principal product, DART (Dynamic Advertising, Reporting, and Targeting), helped publishers sell their inventory and helped advertisers target their advertising more effectively, improving the return of their ad budgets. After listing in 1998, DoubleClick purchased Abacus Direct in 1999. Abacus Direct specialized in selling consumer-purchasing data to catalogue firms. It became obvious, very early on in this journey, that the more you know about your customer the better you could target them, and the more valuable your services. Privacy advocates complained the acquisition would allow DoubleClick to combine online cookie data with offline identity data. The FTC (Federal Trade Commission) found no wrongdoing.

In 2005, the Right Media Exchange was launched as the first global ad exchange. While matching sellers of excess inventory with buyers was a clever enough solution, the real innovation came from allowing advertisers to buy only the ad space that matched their customer targeting requirements. This meant brands could target limited ad budgets to very specific customer demographics.

Google buys DoubleClick

Ultimately DoubleClick was bought by Google, Right Media was purchased by Yahoo, and Appnexus, a third competitor, was purchased by Microsoft. It didn’t take long for the dominant media platforms to further centralize and consolidate the digital advertising ecosystem. In 2018, Google rebranded Google AdWords (their search business) and DoubleClick ad products into three new divisions; Google Ads, Google Marketing Platform and Google Ad Manager.

In 2010, Real-Time Bidding emerged as the ultimate matching solution. Now, in under 100ms, advertisers could bid for each individual ad impression based on user metrics. Demand Side Platforms (DSP) and Supply Side Platforms (SSP) emerged to help advertisers optimise their budgets and to help publishers sell their ad inventory. Data Management Platforms (DMP) emerged to provide advertisers with data to help them evaluate what each user was worth and how well they matched their particular customer targeting needs. The use of cookies exploded as publishers sought to collect more user data. Data Management Platforms have systematically aggregated that personal data, typically without permission, process it, and sold it to advertisers via Demand Side Platforms.

Walled Gardens

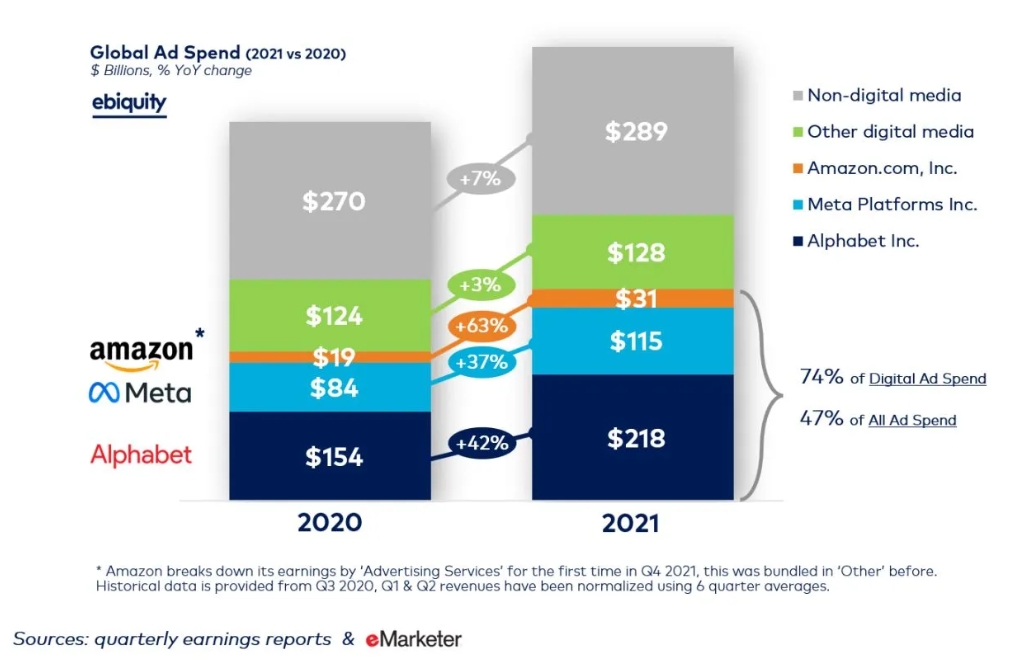

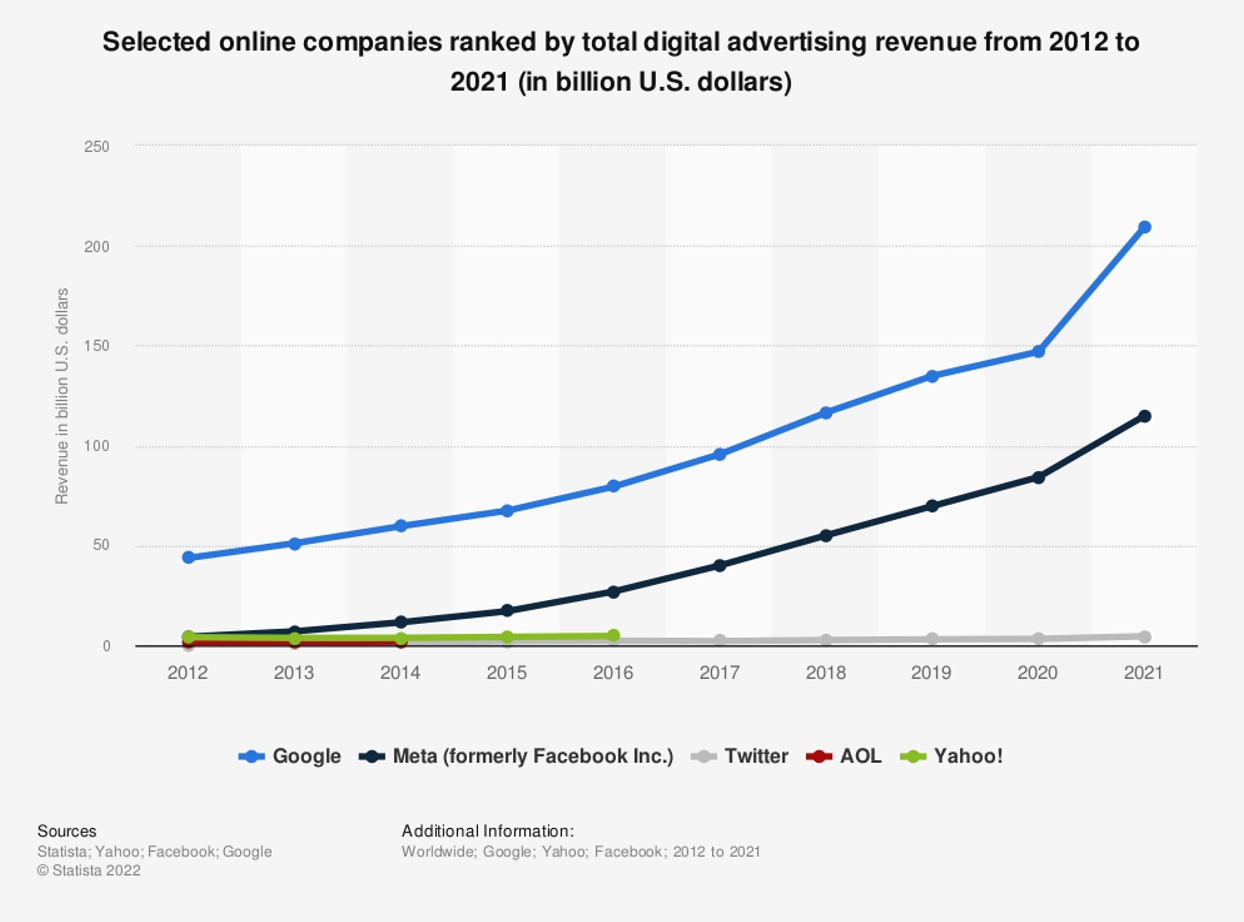

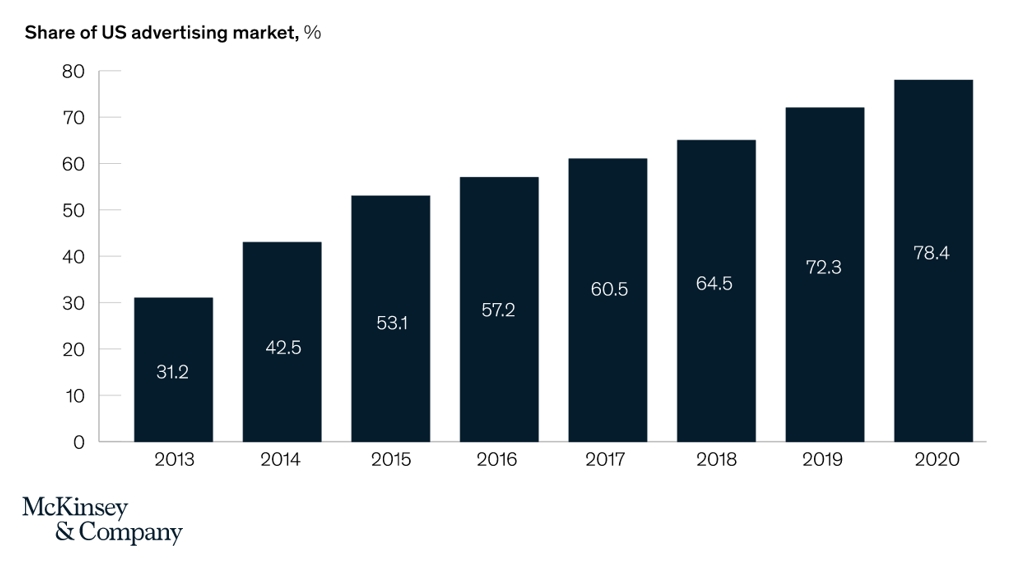

Around this time, Walled Garden operators (Facebook, Google, and Amazon, but also Tencent, Baidu and Alibaba) started to get meaningful traction. The closed nature of those systems bifurcated the digital advertising landscape. To advertise with the walled garden operators typically means access to much higher quality target audience data at the cost of lower pricing power. To advertise outside those systems means relying more on third-party cookies and data management providers. It is quite remarkable just how much market share is now captured by Google and Facebook, in particular. According to Digiday, in 2021 Google, Meta (Facebook) and Amazon accounted for 74% of global digital advertising spend. That suggests that, for the first time, they reached a dominant share of the entire global advertising market.

A dearth of competition

To put a little more context around the current lack of competition, in 2021, Alphabet grew advertising revenues by 42% year-on-year , Meta by 37%, Amazon by 63% and Apple by 230% (estimated) while the rest of the digital media market grew revenues by, wait for it, 3%. These are extraordinary numbers in both absolute and relative terms. Especially when you consider how politicians are arguing for a break up of big tech all while funnelling more revenue into big tech as a result of more stringent privacy regulations. This suggests a somewhat dysfunctional landscape.

Apple

A quick digression on Apple; the extraordinary growth in the company’s 2021 advertising revenues (admittedly off a relatively smaller base) is a result of their recent clampdown on app user tracking. Clamping down on app tracking forces advertisers to advertise directly with Apple, using the data that Apple itself harvests from users (including your transaction history, all the information you share in your account, and what they infer from your app purchases). At the same time, Apple promotes their privacy-preserving features. This is a remarkable sleight of hand. Apple, like Google and Facebook, is using privacy to force advertisers into their walled garden.